The income tax Act prescribes a specific mode for calculation of income and taxability in the case of

Association of Persons.

Let’s first discuss what is an Association of Persons and Body of Individuals.

An association of persons means an association in which two or more persons join in a common purpose or

common action. The term person includes any company or association or body of individuals, whether

incorporated or not. An association of persons may have companies, firms, joint families as its members –

M.M Ipoh v CIT [1968] 67 ITR 106(SC).

Now let’s see how income of Association of Persons (AoP)/ Body of Individuals (BoI) is determined.

Computation of Income of AoP

The total income under the different heads i.e. Income from house property, Profits or gains of business or

profession, Capital gains, and income from other sources shall be worked out ignoring incomes exempt

under Sections 10 to 13A.

From this make adjustments for the following:

If salary, commission, bonus or remuneration is paid by AoP/BoI to members, it will be added

back. It may be noted that remuneration paid for actual services is also disallowed. This is due to

the express provision in Section 40(ba).

If interest is paid by AoP/BoI to members, it will be added back. But the following should be kept

in mind:

Additional points to be kept in mind while disallowing interest:

Where interest is paid by an AoP/BoI to any member who has also paid interest to the AoP/BoI, the

amount of interest to be disallowed shall be limited to the amount by which the payment of interest by the

AoP/BoI to the member exceeds the payment of interest by the member to AoP/BoI.

If individual is member in representative capacity:

(a) Interest paid by the AoP/BoI to such individual or by such individual to AoP/BoI except as member in

a representative capacity, shall not be taken into account;

(b) Interest paid by the AoP/BoI to such individual or by such individual to the AoP/BoI as member in a

representative capacity and interest paid by the AoP/BoI to the person(s) so represented to the AoP/BoI,

shall be taken into account.

Let me elucidate with an example:

Mr. William is a member of an AoP on behalf of his HUF i.e. in representative capacity. AoP pays

interest on capital Rs. 1,50,000 to Mr. William in individual capacity. This amount will be deductible for

the AoP as Mr. William is member in representative capacity but payment is made in individual capacity.

Had Mr. William received interest on behalf of his HUF, such payment would’ve been disallowed in the

hands of AoP.

If individual is member in individual capacity:

Interest paid by the AoP/BoI to such individual shall not be taken into account, if such interest is received

by him on behalf, or for the benefit, of any other person.

Example: Mr. Varun is a member of an AoP i.e. in individual capacity. He receives interest on capital

Rs. 1,50,000 made by his wife. This means he has received interest in representative capacity. Hence it

will be allowed in the hands of AoP. Had Mr. Varun been a member on behalf of his wife, such interest

received would have been disallowed by virtue of Section 40(ba).

Also, deductions under Sections 80G, 80GGA, 80GGC, 80-IA, 80-IAB, 80-IB, 80-IC, 80-ID, 80-IE and

80JJA are to be adjusted (if any).

Total income thus obtained is taxed either at rates applicable to individual or at the maximum marginal

rate, or a rate higher than maximum marginal rate.

Calculation of Tax of AoP

Tax of AoP/BoI shall depend on whether shares of members are determinable or not.

A. Shares of members are determinable:

a) If no member of AoP/BoI has income exceeding maximum amount not chargeable to tax:

The tax is chargeable on the total income of an AoP/BoI at the same rate as is applicable in the

case of an individual.

b) If any member of AoP/BoI has income exceeding maximum amount not chargeable to tax:

In this case, AoP is taxed at maximum marginal rate.

c) And finally, if the total income of any member of the AOB/BOI (whether or not it exceeds the

maximum amount not chargeable to tax in the case of an individual) is chargeable to tax at a rate

higher than the maximum marginal rate, tax shall be charged

- on that portion of the total income of the AOP/BOI which is relatable to such member at

such higher rate

- and the balance of the total income of the AOP/BOI shall be taxed at the maximum

marginal rate, 33.99%.

Let me illustrate the third point above with an example:

RAY Ltd (a foreign Company taxed at 40% + cess), Mr. Mark and Ms.Vidya are members of an

AoP sharing profits in 9:5:6. Personal incomes of the members are as follows:

RAY Ltd- Nil

Mr. Mark – Rs. 30,000

Ms. Vidya – Rs. 13,000.

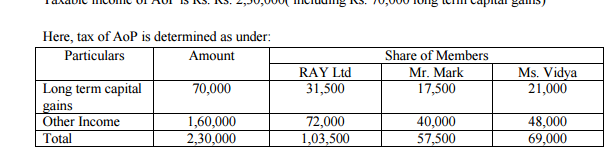

Taxable income of AoP is Rs. Rs. 2,30,000( including Rs. 70,000 long term capital gains)

Here, tax of AoP is determined as under:

Particulars Amount Share of Members

RAY Ltd Mr. Mark Ms. Vidya

Long term capital

gains

70,000 31,500 17,500 21,000

Other Income 1,60,000 72,000 40,000 48,000

Total 2,30,000 1,03,500 57,500 69,000

Here, Rs. 72,000 being share in ‘other income’ of RAY Ltd is taxed at maximum marginal rate.

Tax liability of AoP:

A On Rs. 72,000 at 40% + cess (RAY Ltd being a foreign company) Rs. 29,664

On balance Rs. 1,58,000 (Rs.2,30,000- Rs.72,000)

B At 20% + cess on LTCG, Rs. 70,000 Rs. 14,420

C At max marginal rate on balance Rs. 88,000 Rs. 29,911

Total tax Rs. 73,995 (A+B+C)

B. Shares of members are indeterminable:

Tax is charged on the total income of the AOP/BOI at the maximum marginal rate. However if

any member is charged at a higher rate than maximum marginal rate, the income shall be taxed at

such higher rate.

Calculation of Tax of members:

The assessment of the members of AOP or BOI depends on whether the AOP or BOI is chargeable

to tax at the maximum marginal rate or rates applicable to individual or is not chargeable to tax at all.

Lets discuss it here below:

(i) Where AOP or BOI is chargeable to tax at a maximum marginal rate or any higher rate, the share of

profit of a member is not included in his total income.

(ii) Where AOP or BOI is taxed at rates applicable to individual, the share of profit of a member from AOP

or BOI is to be included in the total income of the member. But, the member is entitled to a rebate of tax

on the entire share of profit at the average rate of tax applicable to total income.

(iii) Where AOP or BOI is not chargeable to tax at all, the share of profit of a member from AOP or BOI is

included in his total income and he will pay tax on it. He is not entitled to any rebate of tax on such profits.