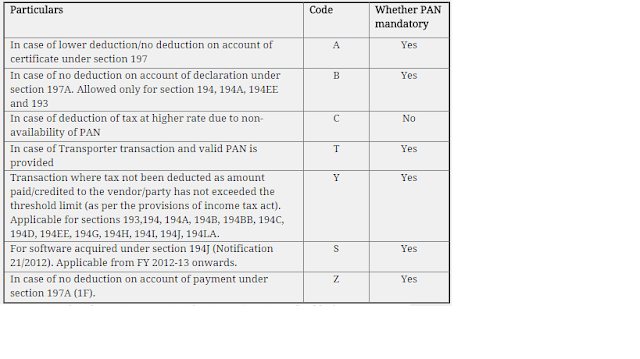

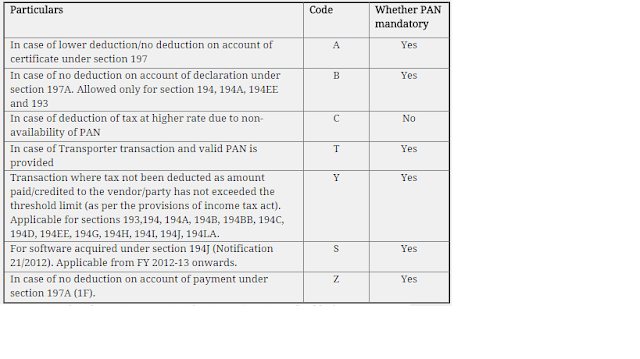

It is generally found that we receive tds default notice due to wrong selection of flag in TDS returns. Therefore it is beneficial to know for all deductors regarding value of Flags which are explained below :-

[TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY,

PART-II, SECTION 3, SUB-SECTION (ii)]

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

(DEPARTMENT OF REVENUE)

(CENTRAL BOARD OF DIRECT TAXES)

NOTIFICATION NO. 21/2012 [F.No.142/10/2012-SO(TPL)] S.O. 1323(E), DATED 13-6-2012

In exercise of the powers conferred by sub-section(1F) of section 197A of the Income-tax Act, 1961 (43 of

1961), the Central Government hereby notifies that no deduction of tax shall be made on the following

specified payment under section 194J of the Act, namely:-

Payment by a person (hereafter referred to as the transferee) for acquisition of software from another person, being a resident, (hereafter referred to as the transferor), where-

(i) the software is acquired in a subsequent transfer and the transferor has transferred the software without any modification,

(ii) tax has been deducted-

(a) under section 194J on payment for any previous transfer of such software; or

(b) under section 195 on payment for any previous transfer of such software from a non-resident, and

(iii) the transferee obtains a declaration from the transferor that the tax has been deducted either under sub-clause (a) or (b) of clause (ii) along with the Permanent Account Number of the transferor.

2. This notification shall come in to force from the 1st day of July, 2012.

(J. Saravanan)

Under Secretary(TPL-III)

In case of no deduction on account of payment under section 197A (1F).

NOTIFICATION NO. 56/2012 [F. NO. 275/53/2012-IT(B)], DATED 31-12-2012

In exercise of the powers conferred by sub-section (1F) of section 197A of the Income-tax Act, 1961 (43 of 1961), the Central Government hereby notifies that no deduction of tax under Chapter XVII of the said Act shall be made on the payments of the nature specified below, in case such payment is made by a person to a bank listed in the Second Schedule to the Reserve Bank of India Act, 1934 (2 of 1934), excluding a foreign bank, namely:-

(i) bank guarantee commission;

(ii) cash management service charges;

(iii) depository charges on maintenance of DEMAT accounts;

(iv) charges for warehousing services for commodities;

(v) underwriting service charges;

(vi) clearing charges (MICR charges);

(vii) credit card or debit card commission for transaction between the merchant establishment and acquirer bank.

2. This notification shall come into force from the Ist day of January, 2013.

[TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY,

PART-II, SECTION 3, SUB-SECTION (ii)]

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

(DEPARTMENT OF REVENUE)

(CENTRAL BOARD OF DIRECT TAXES)

NOTIFICATION NO. 21/2012 [F.No.142/10/2012-SO(TPL)] S.O. 1323(E), DATED 13-6-2012

In exercise of the powers conferred by sub-section(1F) of section 197A of the Income-tax Act, 1961 (43 of

1961), the Central Government hereby notifies that no deduction of tax shall be made on the following

specified payment under section 194J of the Act, namely:-

Payment by a person (hereafter referred to as the transferee) for acquisition of software from another person, being a resident, (hereafter referred to as the transferor), where-

(i) the software is acquired in a subsequent transfer and the transferor has transferred the software without any modification,

(ii) tax has been deducted-

(a) under section 194J on payment for any previous transfer of such software; or

(b) under section 195 on payment for any previous transfer of such software from a non-resident, and

(iii) the transferee obtains a declaration from the transferor that the tax has been deducted either under sub-clause (a) or (b) of clause (ii) along with the Permanent Account Number of the transferor.

2. This notification shall come in to force from the 1st day of July, 2012.

(J. Saravanan)

Under Secretary(TPL-III)

In case of no deduction on account of payment under section 197A (1F).

NOTIFICATION NO. 56/2012 [F. NO. 275/53/2012-IT(B)], DATED 31-12-2012

In exercise of the powers conferred by sub-section (1F) of section 197A of the Income-tax Act, 1961 (43 of 1961), the Central Government hereby notifies that no deduction of tax under Chapter XVII of the said Act shall be made on the payments of the nature specified below, in case such payment is made by a person to a bank listed in the Second Schedule to the Reserve Bank of India Act, 1934 (2 of 1934), excluding a foreign bank, namely:-

(i) bank guarantee commission;

(ii) cash management service charges;

(iii) depository charges on maintenance of DEMAT accounts;

(iv) charges for warehousing services for commodities;

(v) underwriting service charges;

(vi) clearing charges (MICR charges);

(vii) credit card or debit card commission for transaction between the merchant establishment and acquirer bank.

2. This notification shall come into force from the Ist day of January, 2013.