COMPANY REGISTRATION PROCESS FOR NON RESIDENT INDIAN (NRI’s)

With over 20 million in population and with investment size of over US$4000 million in last 10 years, NRI plays an important role in Indian Growth history. NRI are those individuals who are the citizen of India but are resident outside India. We often overlook the term NR with NRI. However, both the terms are very much different and Indian legal system has different set of laws for both of them. NRI are citizen of India, i.e. they hold the valid Indian passport but are residing outside India, and however, if the NRI gets the citizenship of other country, then he will have to surrender his Indian passport and then he will be treated as foreign national i.e. Non-resident (NR).

Laws are always complex and in India laws are very complex. Though, it’s not possible to get into the details through articles but we can have a broader idea about how it is different for NRI to run business in India.

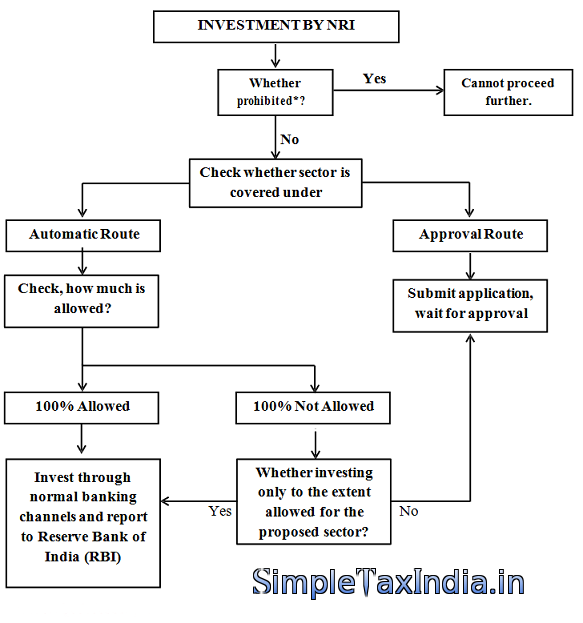

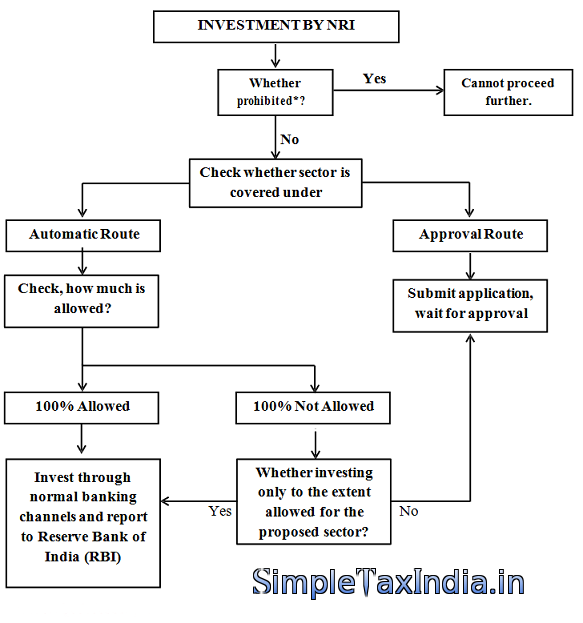

Investments in India are governed by the Foreign Direct Investment (FDI) policy and FEMA Regulations. FDI policy contains set of rules which are to be followed while investing in India and it is sector specific, i.e. there are different rules for different sector. It provides two entry routes to invest in India.

1. Automatic Route: It means that a person can invest in India, without taking any approval subject to the limit specified.

2. Approval Route: It means investment can be made only with the prior approval from the Reserve Bank of India (RBI).

There are many forms of business like Private Company, Partnership etc. However, a NRI cannot freely invest in any form. Entry routes differ according to the form you take to invest. It works like a chain and it went like this

*Prohibited sector includes Lottery business, chit funds, Real estate business or construction of farm house, Manufacturers of cigars, Tobacco etc., Railway, Atomic etc.

Now, after considering the above policy, an eligible NRI may seek to incorporate a company in India. There are three types of companies can be formed in India, however, OPC cannot be formed by NRI.

Now let us see the steps to incorporate a company in India by NRI’s.

1. Apply for DSC: DSC is a basic requirement to start the registration process. To apply for DSC, NRI will have to submit application accompanied by income tax PAN (Permanent Account Number, e.g ANXPS****R), Address proof notarised by Indian embassy at the country where he resides. It generally take 1-3 days.

2. Apply for Director Identification number (DIN): After DSC is acquired; now applicant should apply for DIN number. DIN application in Form DIR 3 will be submitted along with declaration, PAN card and address proof in prescribed format. It shall be noted that one director should be a resident of India (as per new rules). It takes one day.

3. Name Approval: After allotment of approved DIN, the applicant shall apply for Name approval application in Form INC-1.

Name should be unique and should not be prohibited (refer Name Availability Guidelines).

Name approval may take 3-6 days.

4. Application for Incorporation: After Name approval the applicant shall apply for incorporation application. This shall be accompanied by prescribed documents such as residential proofs, identity proofs, and Address proofs for registered Office. Form shall also be accompanied by declaration and certificate by a professional. This can take 4-6 days. MOA and AOA are drafted at this stage only.

5. Appointment of Directors: This form shall be filed with the form of incorporation. Through this form, director gives their consent to act as a director of the proposed companies. This form shall also be accompanied by the declaration in prescribed formats.

6. Registered Office: After the incorporation, this form shall be filed within 30 days from the date of incorporation. This form shall be accompanied by address proof of registered office.

Though the MCA have tried to simplify the registration process, yet it is very complication and it is too much to expect from the common man to register a company by itself. Such a naïve will always be at a mercy of professional.

However, at Quickcompany.in, we have eliminated the dependency of NRI’s on the professionals. Now, a NRI or anyone can easily incorporate a company by visiting Quickcompany.in.

With over 20 million in population and with investment size of over US$4000 million in last 10 years, NRI plays an important role in Indian Growth history. NRI are those individuals who are the citizen of India but are resident outside India. We often overlook the term NR with NRI. However, both the terms are very much different and Indian legal system has different set of laws for both of them. NRI are citizen of India, i.e. they hold the valid Indian passport but are residing outside India, and however, if the NRI gets the citizenship of other country, then he will have to surrender his Indian passport and then he will be treated as foreign national i.e. Non-resident (NR).

Laws are always complex and in India laws are very complex. Though, it’s not possible to get into the details through articles but we can have a broader idea about how it is different for NRI to run business in India.

Investments in India are governed by the Foreign Direct Investment (FDI) policy and FEMA Regulations. FDI policy contains set of rules which are to be followed while investing in India and it is sector specific, i.e. there are different rules for different sector. It provides two entry routes to invest in India.

1. Automatic Route: It means that a person can invest in India, without taking any approval subject to the limit specified.

2. Approval Route: It means investment can be made only with the prior approval from the Reserve Bank of India (RBI).

There are many forms of business like Private Company, Partnership etc. However, a NRI cannot freely invest in any form. Entry routes differ according to the form you take to invest. It works like a chain and it went like this

*Prohibited sector includes Lottery business, chit funds, Real estate business or construction of farm house, Manufacturers of cigars, Tobacco etc., Railway, Atomic etc.

Now, after considering the above policy, an eligible NRI may seek to incorporate a company in India. There are three types of companies can be formed in India, however, OPC cannot be formed by NRI.

Now let us see the steps to incorporate a company in India by NRI’s.

1. Apply for DSC: DSC is a basic requirement to start the registration process. To apply for DSC, NRI will have to submit application accompanied by income tax PAN (Permanent Account Number, e.g ANXPS****R), Address proof notarised by Indian embassy at the country where he resides. It generally take 1-3 days.

2. Apply for Director Identification number (DIN): After DSC is acquired; now applicant should apply for DIN number. DIN application in Form DIR 3 will be submitted along with declaration, PAN card and address proof in prescribed format. It shall be noted that one director should be a resident of India (as per new rules). It takes one day.

3. Name Approval: After allotment of approved DIN, the applicant shall apply for Name approval application in Form INC-1.

Name should be unique and should not be prohibited (refer Name Availability Guidelines).

Name approval may take 3-6 days.

4. Application for Incorporation: After Name approval the applicant shall apply for incorporation application. This shall be accompanied by prescribed documents such as residential proofs, identity proofs, and Address proofs for registered Office. Form shall also be accompanied by declaration and certificate by a professional. This can take 4-6 days. MOA and AOA are drafted at this stage only.

5. Appointment of Directors: This form shall be filed with the form of incorporation. Through this form, director gives their consent to act as a director of the proposed companies. This form shall also be accompanied by the declaration in prescribed formats.

6. Registered Office: After the incorporation, this form shall be filed within 30 days from the date of incorporation. This form shall be accompanied by address proof of registered office.

Though the MCA have tried to simplify the registration process, yet it is very complication and it is too much to expect from the common man to register a company by itself. Such a naïve will always be at a mercy of professional.

However, at Quickcompany.in, we have eliminated the dependency of NRI’s on the professionals. Now, a NRI or anyone can easily incorporate a company by visiting Quickcompany.in.

0 comments:

Post a Comment