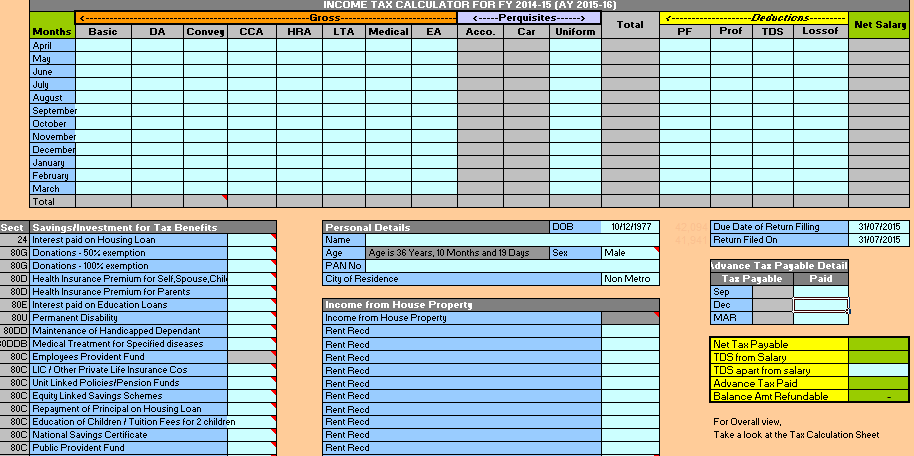

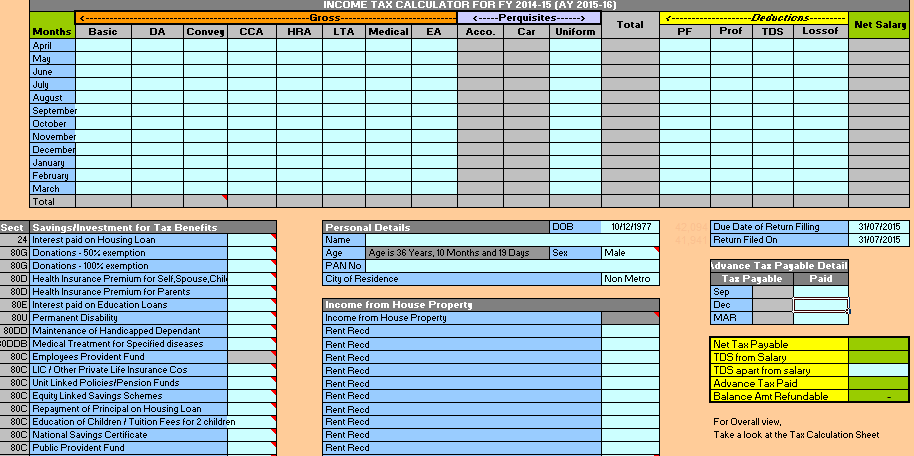

Income Tax Calculator for Assessment Year 2015-16 (Financial Year 2014-15) india Excel free Download

——————————————————-****————————–

Related:

(* CLICK HERE TO GET IT CALCULATOR A Y 2016-17*)

OR

LINK 2: FINANCIAL YEAR (FY) 2015-16

——————————————————-****————————–

Income Tax Slab for A.Y. 2015-16 (F.Y. 2014-15)

Individual resident aged below 60 years (i.e. born on or after 1st April 1955) or any NRI / HUF / AOP / BOI / AJP*

Income Slabs Tax Rates:

i. Where the total income does not exceed Rs. 2,50,000/-. NIL

ii. Where the total income exceeds Rs. 2,50,000/- but does not exceed Rs. 5,00,000/-. 10% of amount by which the total income exceeds Rs. 2,50,000/-.

Less ( in case of Resident Individuals only ) : Tax Credit u/s 87A – 10% of taxable income upto a maximum of Rs. 2000/-.

iii. Where the total income exceeds Rs. 5,00,000/- but does not exceed Rs. 10,00,000/-. Rs. 25,000/- + 20% of the amount by which the total income exceeds Rs. 5,00,000/-.

iv. Where the total income exceeds Rs. 10,00,000/-. Rs. 125,000/- + 30% of the amount by which the total income exceeds Rs. 10,00,000/-.

Surcharge : 10% of the Income Tax, where total taxable income is more than Rs. 1 crore. (Marginal Relief in Surcharge, if applicable)

Education Cess : 3% of the total of Income Tax and Surcharge.

* Abbreviations used :

NRI – Non Resident Individual; HUF – Hindu Undivided Family; AOP – Association of Persons; BOI – Body of Individuals; AJP – Artificial Judicial Person

Individual resident who is of the age of 60 years or more but below the age of 80 years at any time during the previous year (i.e. born on or after 1st April 1934 but before 1st April 1954)

Income Slabs Tax Rates:

i. Where the total income does not exceed Rs. 3,00,000/-. NIL

ii. Where the total income exceeds Rs. 3,00,000/- but does not exceed Rs. 5,00,000/- 10% of the amount by which the total income exceeds Rs. 3,00,000/-.

Less : Tax Credit u/s 87A – 10% of taxable income upto a maximum of Rs. 2000/-.

iii. Where the total income exceeds Rs. 5,00,000/- but does not exceed Rs. 10,00,000/- Rs. 20,000/- + 20% of the amount by which the total income exceeds Rs. 5,00,000/-.

iv. Where the total income exceeds Rs. 10,00,000/- Rs. 120,000/- + 30% of the amount by which the total income exceeds Rs. 10,00,000/-.

Surcharge : 10% of the Income Tax, where total taxable income is more than Rs. 1 crore. (Marginal Relief in Surcharge, if applicable)

Education Cess : 3% of the total of Income Tax and Surcharge.

Individual resident who is of the age of 80 years or more at any time during the previous year (i.e. born before 1st April 1934)

Income Slabs Tax Rates:

i. Where the total income does not exceed Rs. 5,00,000/-. NIL

ii. Where the total income exceeds Rs. 5,00,000/- but does not exceed Rs. 10,00,000/- 20% of the amount by which the total income exceeds Rs. 5,00,000/-.

iii. Where the total income exceeds Rs. 10,00,000/- Rs. 100,000/- + 30% of the amount by which the total income exceeds Rs. 10,00,000/-.

Surcharge : 10% of the Income Tax, where total taxable income is more than Rs. 1 crore. (Marginal Relief in Surcharge, if applicable)

Education Cess : 3% of the total of Income Tax and Surcharge.

Co-operative Society:

Income Slabs Tax Rates

Income Slabs Tax Rates

i. Where the total income does not exceed Rs. 10,000/-. 10% of the income.

ii. Where the total income exceeds Rs. 10,000/- but does not exceed Rs. 20,000/-. Rs. 1,000/- + 20% of income in excess of Rs. 10,000/-.

iii. Where the total income exceeds Rs. 20,000/- Rs. 3.000/- + 30% of the amount by which the total income exceeds Rs. 20,000/-.

Surcharge : 10% of the Income Tax, where total taxable income is more than Rs. 1 crore. (Marginal Relief in Surcharge, if applicable)

Education Cess : 3% of the total of Income Tax and Surcharge.

Firm:

Income Tax : 30% of total income.

Surcharge : 10% of the Income Tax, where total taxable income is more than Rs. 1 crore. (Marginal Relief in Surcharge, if applicable)

Education Cess : 3% of the total of Income Tax and Surcharge.

Local Authority

Income Tax : 30% of total income.

Surcharge : 10% of the Income Tax, where total taxable income is more than Rs. 1 crore. (Marginal Relief in Surcharge, if applicable)

Education Cess : 3% of the total of Income Tax and Surcharge.

Domestic Company:

Income Tax : 30% of total income.

Surcharge : The amount of income tax as computed in accordance with above rates, and after being reduced by the amount of tax rebate shall be increased by a surcharge

At the rate of 5% of such income tax, provided that the total income exceeds Rs. 1 crore. (Marginal Relief in Surcharge, if applicable)

At the rate of 10% of such income tax, provided that the total income exceeds Rs. 10 crores.

Education Cess : 3% of the total of Income Tax and Surcharge.

Company other than a Domestic Company

Income Tax :

@ 50% of on so much of the total income as consist of (a) royalties received from Government or an Indian concern in pursuance of an agreement made by it with the Government or the Indian concern after the 31st day of March, 1961 but before the 1st day of April, 1976; or (b) fees for rendering technical services received from Government or an Indian concern in pursuance of an agreement made by it with the Government or the Indian concern after the 29th day of February, 1964 but before the 1st day of April, 1976, and where such agreement has, in either case, been approved by the Central Government.

@ 40% of the balance

Surcharge :

The amount of income tax as computed in accordance with above rates, and after being reduced by the amount of tax rebate shall be increased by a surcharge as under

At the rate of 2% of such income tax, provided that the total income exceeds Rs. 1 crore. (Marginal Relief in Surcharge, if applicable)

At the rate of 5% of such income tax, provided that the total income exceeds Rs. 10 crores.

Education Cess : 3% of the total of Income Tax and Surcharge.

Marginal Relief : When an assessee’s taxable income exceeds Rs. 1 crore, he is liable to pay Surcharge at prescribed rates mentioned above on Income Tax payable by him. However, the amount of Income Tax and Surcharge shall not increase the amount of income tax payable on a taxable income of Rs. 1 crore by more than the amount of increase in taxable income.

Example :

In case of an individual assesseee (

1. Income Tax Rs. 28,30,300

2. Surcharge @10% of Income Tax Rs. 2,83,030

3. Income Tax on income of Rs. 1 crore Rs. 28,30,000

4. Maximum Surcharge payable

(Income over Rs. 1 crore less income tax on income over Rs. 1 crore) Rs. 700/- (1000 – 300)

5. Income Tax + Surcharge payable Rs. 28,31,000

6. Marginal Relief in Surcharge Rs. 2,82,330/- (2,83,030 – 700)

DOWNLOAD EXCEL CALCULATOR

OR DOWNLOAD VIA MIRROR 2

——————————————————-****————————–

ALSO:

(* CLICK HERE TO GET IT CALCULATOR A Y 2016-17*)

OR

LINK 2: FINANCIAL YEAR (FY) 2015-16 / A Y 2016-17.