– Open Google Search Engine

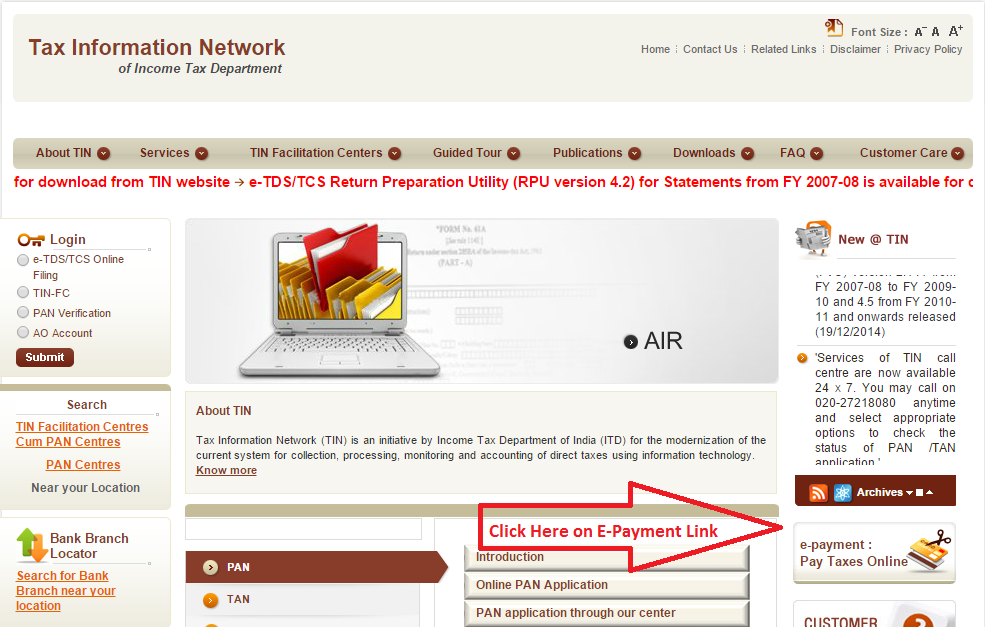

– Now Enter – www.tin-nsdl.com

– Open TIN-NSDL Website

– Select E-Payment to Taxes on right hand side

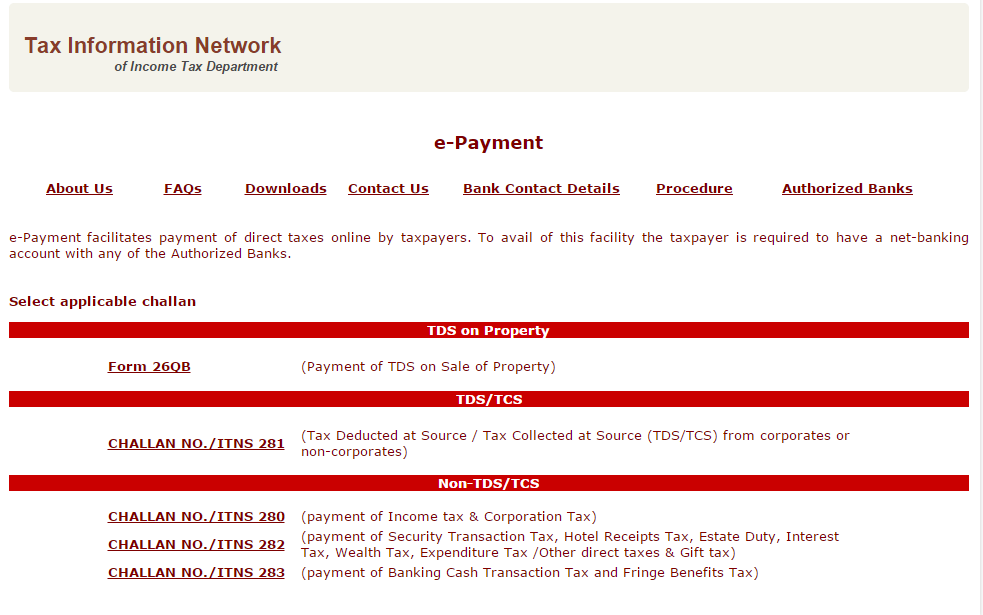

– Now You Can See Next Screen i.e Tin-Nsdl E-payment Website

– You Can Direct Open This Website By Click on Following Link

https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

Now Click here to “Click to pay tax online“

Now You can See Following Screen in Your Browser

Now You can Click On Challan No./ITNS 281

– (Tax Deducted at Source / Tax Collected at Source (TDS/TCS) from corporates or non-corporates)

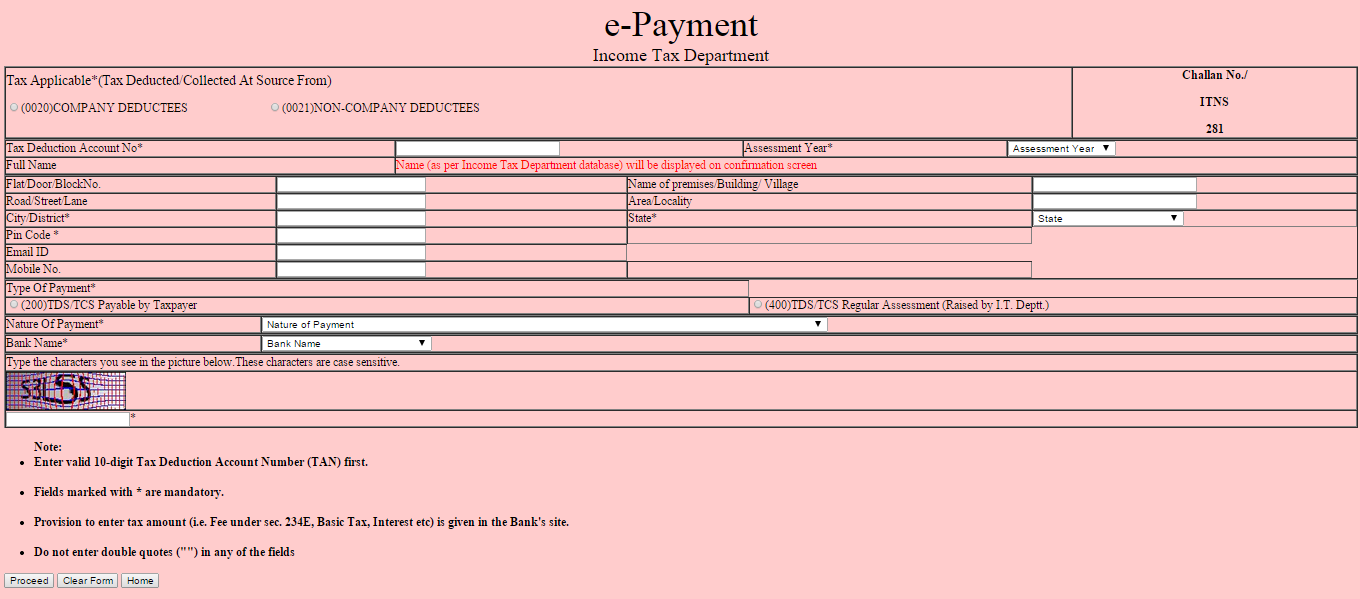

– Now You can See Following Screen in Your Browser

Now You can Fill all the Entries and Click on Process Button Like

– Enter Address and State must.

– Select Type of payment as (200)

– Select correct nature of payment

– ie., Rent, Contract, Professional Expenses etc.

– Select Bank from which you are making payment

– Enter the case sensitive characters in the box given

– In the next screen confirm the name displayed and financial year.

– After you confirm all the details click proceed for online payment and preserve the challan for E TDS Filing.