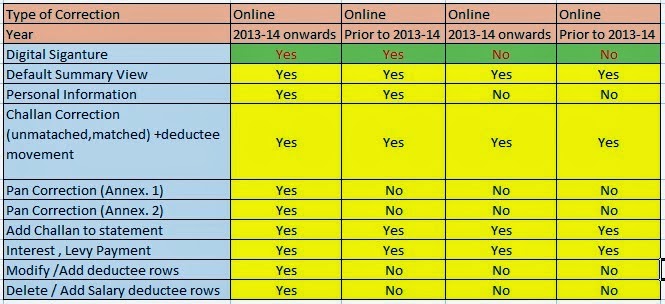

Deductors are requested to check below screen before taking any action for TDS return online correction which will be helpful for him

Type of Correction Online Online Online Online

Year 2013-14 onwards Prior to 2013-14 2013-14 onwards Prior to 2013-14

Digital Siganture Yes Yes No No

Default Summary View Yes Yes Yes Yes

Personal Information Yes Yes No No

Challan Correction (unmatached,matched) +deductee movement

Yes Yes Yes Yes

Pan Correction (Annex. 1) Yes No No No

Pan Correction (Annex. 2) Yes No No No

Add Challan to statement Yes Yes Yes Yes

Interest , Levy Payment Yes Yes Yes Yes

Modify /Add deductee rows Yes No No No

Del / Add Sal. deductee rows Yes No No No