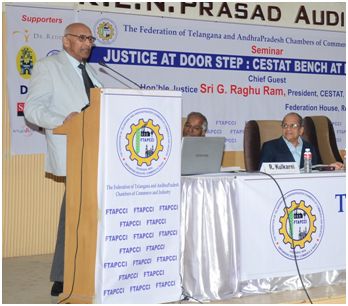

CESTAT President Justice Raghuram had on Saturday held an elite audience of assessees and advocates, Commissioners and consultants in rapturous attention in two spells of his electrifying speech at the FAPCCI in Hyderabad. FAPCCI had organised a seminar in connection with the hopeful establishment of a Bench of CESTAT at Hyderabad. The Bench is sanctioned, but it is yet to take off due to certain organisational difficulties.

Addressing the FAPCCI in June 2013, Justice Raghuram had said that the proposal to start a CESTAT Bench at Hyderabad is seven months pregnant but he was not sure of a safe delivery in nine months. (DDT 2123).

Addressing the FAPCCI in June 2013, Justice Raghuram had said that the proposal to start a CESTAT Bench at Hyderabad is seven months pregnant but he was not sure of a safe delivery in nine months. (DDT 2123).

Addressing the FAPCCI after nearly two years, the Justice said,

“The trauma is that the huge pendency of cases at Bangalore representing four states Andhra Pradesh, Telangana, Karnataka and Kerala and as usual in every sector the supply demand mismatch; too few members of the tribunal chasing too many cases. The lawyer is trained in the art of waiting – the more the waiting, it is economically profitable sometimes but nevertheless the trauma on the client both in economic terms and time terms. To that extent the Hyderabad bench would possibly alleviate some of the hibernation of the appeals.

We have the physical infrastructure. We have located building and we are paying rent through our noses – public money but we still have a few issues. Government of India has sanctioned us a modest amount, too modest for our needs and the Central Public Works Department has an extravagant estimate. When I saw the estimate, I was wondering whether we are constructing the Rashtrapati Bhavan again. Now that negotiation is going on and some via media between government’s modest sanction and CPWD’s extravagant estimate will be reached. Some compromise will be reached and work will start; that is so far as the physical infrastructure is concerned.

We have the physical infrastructure. We have located building and we are paying rent through our noses – public money but we still have a few issues. Government of India has sanctioned us a modest amount, too modest for our needs and the Central Public Works Department has an extravagant estimate. When I saw the estimate, I was wondering whether we are constructing the Rashtrapati Bhavan again. Now that negotiation is going on and some via media between government’s modest sanction and CPWD’s extravagant estimate will be reached. Some compromise will be reached and work will start; that is so far as the physical infrastructure is concerned.

So far as the incumbency infrastructure is concerned we have been able to finalize selection of technical members and it is at an advanced stage of process with the highest authorities of the Republic. As far as selection of judicial members is concerned, it is a morbid situation. We are not able to get members. And the greater tragedy is that no member of the bar practicing in the tribunal is willing to offer his services to come on to the judicial branch. Even in the higher judiciary this is a problem. Seducing people to public office is a hugely problematic task today; may be it is the habitat of public office; may be it is the lure of the private enterprise that dissuades people – competent honest people to come to public service but then that is a pathology we have to live with in our generation. I do not have judicial members to fill the six additional benches we have created. I have got seven vacancies today; I was able to shortlist only three candidates for the judicial posts. Still there will be four dysfunctional benches in the tribunal. That is my trauma and therefore it is your trauma as well.”

FAPCCI had organised the Seminar with the theme, “Justice at door Step”: CESTAT Bench at Hyderabad, in which Justice Raghuram was the Chief Guest. The speakers were

| Mr. Thirumalai, advocate and a former President of FAPCCI | Gear up for CESTAT Practice – Areas of Cooperation between the Bench, Bar and Stakeholders |

| Mr. G. Natarajan, advocate | What to Present and How to Present at CESTAT? |

| K. Vijay Kumar, Editor in Chief, TIOL | Pre-work at the SCN and First Executive appeal stages |

One of our Netizens present in the Seminar told me, “I would like to see how you will report about yourself”

Some excerpts from the President’s speech:

|

After being a tax judge, I don’t know how to fill my income tax form Something is pathologically, terminally and seriously wrong with our departmental adjudication. If a commissioner thinks (and using commissioner as a common integer for the department) that he is collecting the taxes, the country is in peril because that is what our Hollywood and Bollywood rowdies do; they collect money without the authority of law. My dear Commissioners, you have the power of the Indian Republic behind you. Don’t have the arrogance of power; have the humility of public responsibility People respect you for what you have not done; for not being arrogant, for not being corrupt, for not displaying the pathologies of public power. When the law becomes dysfunctional more harsh laws come. GST Bill: it is mind-boggling constitutional complexity. There is no presumption that the Judge knows the law. |

In religion there are two levels, one is the ritualistic level; the other is the philosophical level. Many a time law and adjudication of legal conflicts is pursued at the ritualistic level; file an application/petition and then file a counter affidavit legitimately or romantically and passionately you pursue, more passionately if your client is sitting behind you. It’s a drama that goes on. At the philosophical level, you try to understand that human conflicts or human conflict resolution – the destination of conflict resolution is not peace. Peace is a state of morbidity. In a human physiological sense, you are at peace only a month after you are dead and all your organic matter dissolves into inorganic elements – till then a dead man is also vibrant. |

A young judge comes with a delusion that in a month he will settle all the disputes. Firstly he will be writing his own obituary if he does that and secondly he can’t do that. We are under no such illusion.

Now the in-utero kid called the GST. It’s a very complex branch of law with due apologies I would say that misses ninety nine percent of the practitioners; the philosophical complexity is this – in a federal democratic context the taxation powers under the constitution are assigned and committed to exclusive lists in 1 and 2. They are not in the concurrent list and neither of the federal partners, the Union or the State is a vassal of the other. They are plenary legislatures exercising plenary assigned powers under the constitution. The States stand on the same footing as the Union and the Union stands on the same footing as the States. And when this hybrid amalgamated transactions are taxed, you are adjudicating the rights of two what are politically called the competing magisteria. They are two magistrates of equal power who have a constitutionally assigned, constitutionally committed, constitutionally allocated, exclusive power of legislation. Under article 246 read with list 1 and 2 who have the right to tax. There were traditional paradigms of thought as to the measure of tax not having anything to do with legislative competence. That is the limited doctrine that has its own place in our jurisprudence. In a federal constitutional jurisprudence, the measure of a tax may also be integrally connected with the legislative competence. For instance if the union taxes the goods element in a works contract and if the State taxes the service element in a contract one way to gloss over this blasphemy is to call it a measure of tax, traditional tax lawyer would call it. But imagine a federal complexity situation, where both tax to such an extent as to make the cake invisible. A State can kill the Union – even a ninety percent taxation cannot be struck down if it is within legislative competence. We had income tax of eighty plus percent. Let us take in a Works Contract situation – State says I will tax eighty percent of the consideration received in a building contract towards sales tax and the Union says I will tax eighty percent towards service tax. It is hundred and sixty percent. This fellow is better off not doing anything, only pickpocketing. When he builds if he gets hundred rupees, he has to pay tax on hundred and sixty rupees. Is it a measure of tax? Traditionally that doctrine has gone up – this is the sociological asymmetry of multiple roles.

Jurisprudential jargon borrowed from unitary constitutions are inappropriate for federal constitutions. Who will tell them, who will teach me; there is no presumption that the judge knows the law and that is the legitimacy of the bar. So what happens – it is the blind leading the blind. In the adjudicating level he is not concerned because his collecting chief commissioner is saying aajkithnalaye ho. Then it comes before – me who has been appointed as member of the tribunal because nobody else was willing. I don’t know the law. You don’t know the law or you are not willing to take the case; it is a small case – how precedents are built up. There are battle of Panipat lawyers – in Law School you were told that measure of tax has nothing to do with legislative competence. You don’t look in to the foundational aspects.

It is a twelve years course to become a vedic scholar; in the first year the student enters the school, with this in mind. Mamayepandithaha – I alone am the pundit. Half the course –mamathepandithaha, I am also a pundit. After twelve years, except me rest of the world is a pundit. It is a realisation of your fallibility. When you are young, you have the infallibility of the ignorance, when you grow old you have the moderation of knowledge and the continued reminder of your temporality – that you are going to die soon. And there is nothing you have learnt.

There are no big and small cases. There are big and small ways of doing things. There is no big and small assessee. There is no simple case; every case has got its own internal profundity, its own complexity. Look at the complexity of human organ – ten thousand trillion cells -It is something that even the most complex commissioner cannot add zeros to. Ten thousand trillion cells of the human body perform their assigned tasks throughout the lifespan of an individual. Your thumbnail does not develop eyesight. If one cell misbehaves, if it forgets to die, or forgets to grow, that pathology can be terminal, it is called carcinoma.

If ten thousand trillion cells in each human body can behave themselves during the lifespan, can you imagine that two members of tribunal cannot agree?

7.2 billion People of the world are equivalent to the cells in one inch of you little finger. That is the grand design of creation. Unless you achieve that synthesis or approximating that synthesis in law and facts you cannot do a good job.

For my practitioner friends I will say, look at the whole; there is no partial myopic look at law and facts. You are a professional, don’t romance values. If you are a surgeon, and if somebody has got cancer of the breast, if you start romancing if it is a cinema actor’s breast or a beggar woman’s breast, your hands will shiver. He has a pathological piece of flesh; he has to deal with it. Look like Arjuna; look at the bird’s eye.

The moment you come to the conclusion that you have understood the law, that is the moment for you to retire from the profession. Learning is a daily process as human beings you will know, when one is dying he takes three or four gasps; each one of us will have to learn it only at that time. Any amount of reading books will not train you for that last breathing. Law is about learning; don’t go with intellectual arrogance into your profession that you know the law. Many of the wrong decisions are contributed by judges who have got arrogance of competence assisted by lawyers who think they know too much.

When it comes to the tribunal, this is the last port of call. I am the last diagnostician in your pathology. You have to get your facts and law processed by me. I remind myself on a daily basis that my audience is not the government, my audience is not the commissioner; my audience is the high court and Supreme Court. I am a single audience movie maker. I got only two members of my audience, the high court and the Supreme Court. The commissioner is also a single audience movie maker. I am the audience for the commissioner. He should be writing to me. Many a time when we are even confirming orders of the commissioner, we are rewriting it so that I can sell commissioner’s order to the high court. I am re-scripting the movie. Many a time as a lawyer you will be assisting judges who do not know the craft of judging, who do not know the craft of scripting a judgement. A judgement has architecture, a judgement has a design, a judgment has a calibration, a judgement has hierarchies of presenting facts. Please remember that you are performing a critical function when you are appearing before the tribunal because very few people can afford to go to the higher levels/appellate levels and they don’t have time to look into too many cases. Another pathology is because the departmental adjudication is so pathologically mediocre with due apologies to my colleagues; the volumes are high the repair work is very voluminous, the catena is large; therefore this is the critical port of call.

Export and Import of Currency-Board reiterates RBI Circular

AS per RBI Circular No. 146, dated 19.06.2014, any person resident in India:

1. may take outside India (other than to Nepal and Bhutan) currency notes of Government of India and Reserve Bank of India notes up to an amount not exceeding Rs.25,000 (Rupees twenty five thousand only); and2. who had gone out of India on a temporary visit, may bring into India at the time of his return from any place outside India (other than from Nepal and Bhutan), currency notes of Government of India and Reserve Bank of India notes up to an amount not exceeding Rs.25,000 (Rupees twenty five thousand only).

This was only Rs. 10,000/- earlier.

Board wants all Chief Commissioners to ensure that the RBI guidelines are scrupulously followed by the officers under their charge. Further, Board wants wide publicity to be given to these guidelines by displaying them at prominent places at the airports etc. so that no harassment is caused to the genuine passengers.

Board wants Officers to be suitably sensitized in the matter. Any non-compliance on the part of the officers will be viewed seriously.

The Customs declaration that passengers are made to give at airports, still carries the amount as Rs.10,000/-

CBEC Circular No.03/2015-Customs., Dated: January 16, 2015

FTP – Import of Mobile handsets with fake IMEI – prohibited

GOVERNMENT has prohibited the import of:

1. GSM mobile handsets’ (classified under ITC (HS) code ‘8517’) without International Mobile Equipment Identity (IMEI) No., with all zeroes IMEI, duplicate IMEI or fake IMEI.2. ‘CDMA mobile handsets’ (classified under ITC (HS) code ‘8517’) without Electronic Serial Number (ESN)/Mobile Equipment Identifier (MEID), with all Zeroes as ESN/MEID, duplicate ESN/MEID or fake ESN/MEID

The Import Policy Condition under ITC (HS) 4 digit code 8517 of Chapter 85 of ITC (HS), 2012 – Schedule – 1 (Import Policy), is amended.

DGFT Notification No.107/(RE-2013)/2009-2014., Dated: January 16, 2015

Excise duty hiked on Petrol & High Speed Diesel…once again

THE crude oil price has slumped to about USD 46 per barrel – a six year low.

The Central government has, therefore, hiked excise duty on petrol and diesel by Rs.2 per litre each to eat into the gains that could have possibly come by way of reduced global oil prices.

All these hikes are supposed to fetch the government an additional Rs.20,000 crore this fiscal and wipe a bit of the deficit.

This is the months’ second hike and the fourth since the duty rates started increasing from 12.11.2014.

Analysts say that the oil glut would continue as the members of the Organisation of the Petroleum Exporting Countries (OPEC) have decided not to cut production and this could have a profound effect on the global economy.

The changes in the duty rates have been effected by once again amending Notification 12/2012-CE.

Considering that the notification is being amended on a fortnightly basis due to the plunging crude oil prices, and which would continue its free fall for some more time, the CBEC may toy with the idea of coming out with a separate notification for Petrol & diesel rather than poking the gargantuan notification 12/2012-CE again and again.

The relevant entries are as below –

Table

|

Sl. No.

|

Chapter or heading or sub-heading or tariff item of the First Schedule

|

Description of excisable goods

|

Rate w.e.f02.01.2015

|

Rate w.e.f17.01.2015

|

|

(1)

|

(2)

|

(3)

|

(4)

|

|

| 70 | 2710 |

Motor spirit commonly known as petrol,- (i) intended for sale without a brand name; (ii) other than those specified at (i) |

Rs.6.95 per litre Rs.8.10 per litre |

Rs.8.95 per litre Rs.10.10 per litre |

| 71 | 2710 19 30 |

High speed diesel (HSD),- (i) intended for sale without a brand name; (ii) other than those specified at (i) |

Rs.5.96 per litre Rs.8.25 per litre |

Rs.7.96 per litre Rs.10.25 per litre |

Notification 03/2015-CE dated January 16, 2015

Jurisprudentiol-Tuesday’s cases

Service Tax

Service Tax

Airport Authority of India loses huge case: Any service provided does not mean any taxable service provided: CESTAT

THE words “any service provided” would cover any service other than those covered by other clauses of section 65(105)(zzm), which have been provided in an Airport or a Civil Enclave by AAI or a person authorised by it.

Interpretation of the expression- “in any airport or a civil enclave”: such services would be treated as having been provided in an Airport or a Civil Enclave if the same have been performed within the area of an Airport/Civil Enclave or are in respect of the immovable property located within the airport/ Civil Enclave area. A service would be treated as performed within the Airport/Civil Enclave area if has been performed by the persons of the AAI/authorised person deployed within the area of Airport/Civil Enclave, irrespective of the location of the equipments/machines with whose help the services has been performed and irrespective of the location of the service recipient.

Income Tax

Whether when Revenue finds during investigation that assessee is beneficiary of accommodation entry it is sufficient to conclude absence of true and full disclosure of all facts by assessee – YES: HC

THE assessee company was served notice u/s 148 for having taken accommodation entries by way of share capital. This was confirmed by one entry provider Mr. Praveen Kumar Jain during the Search that the same was provided as bogus accommodation entries to the beneficiary assessee company. Thus the assessment was reopened by the AO, pursuant to the notice u/s 148 which was issued although beyond the period of four years from the end of the relevant AY i.e. 2007-08. The assessee objected to the same on the ground that on the basis of a statement given by the third party it cannot be inferred that the share application money received by the assessee was in the form of accommodation entry. Besides, the assessee pointed out two of the seven names indicated in the reasons from whom accommodation entries were allegedly taken by the assessee do not even appear in the books of the assessee. This according to the assessee would itself make the information received suspicious and not authentic.

The issue is – Whether the fact revealed during investigation that the assessee is a beneficiary of an accommodation entry is sufficient for the AO to prima-facie conclude the absence of true and full disclosure of all facts – Whether a disclosure even if full may not be true. And the answer favours the Revenue.

Central Excise

Valuation – Glues & Adhesives – Appellants stand that exemption u/r 34 of SWAM Rules, 1977 is not mandatory is not acceptable – as appellants are marking packages as ‘Industrial Use’, they are exempted from affixing MRP and, therefore, goods have be valued u/s 4 of CEA, 1944: CESTAT

THE appellant manufactures “Glues and adhesives” falling under Chapter 35 of the CETA, 1985. The said commodity is notified u/s 4A of the CEA, 1944.

Both lower authorities have confirmed the demand raised on the appellant on the ground that they have wrongly adopted MRP based assessment under the provisions of Section 4A of CEA, 1944 inasmuch as the packing of the products indicated that they were supplied to “industrial consumers” and hence they were not covered by the provisions of Standards of Weight and Measurement Act, 1976.