Page No.

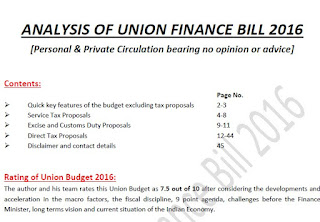

- – Quick key features of the budget excluding tax proposals 2-3

- – Service Tax Proposals 4-8

- – Excise and Customs Duty Proposals 9-11

- – Direct Tax Proposals 12-44

- – Disclaimer and contact details 45

- Rating of Union Budget 2016:

The author and his team rates this Union Budget as 7.5 out of 10 after considering the developments and

acceleration in the macro factors, the fiscal discipline, 9 point agenda, challenges before the Finance

Minister, long terms vision and current situation of the Indian Economy.

Positive Features: There are some positive indication/ proposal such as, Acceleration in the Growth of

economy in 2015-16, Increase in foreign exchange reserves, Agriculture and Farmers welfare, Investment in

social sector and health care sector, Education skills and job creation in India, skill development,

infrastructure development, financial sector reforms, governance and ease of doing business, promoting

affordable housing, simplification and rationalization of taxes, transparent procurement procedure

proposed.

Drawback: However, some of the expectations have been left high and dry, such as no transparency in the

track record of implementation, still no reforms for Banking Sector NPA, no such relief to the middle class

society, no commitments for GST implementation, triple taxation on Dividend.

- Key Features of the Union Finance Budget 2016:

– Growth of Economy accelerated to 7.6% in 2015-16.

– Foreign exchange reserves touched highest ever level of about 350 billion US dollars.

– Continue with the ongoing reform programme and ensure passage of the Goods and Service Tax bill and

Insolvency and Bankruptcy law.

– Giving a statutory backing to AADHAR platform to ensure benefits reach the deserving.

– Allocation for Agriculture and Farmers’ welfare is Rs. 35,984 crore.

– Implementation of 89 irrigation projects under AIBP, which are languishing for a long time, will be fast

tracked.

– A dedicated Long Term Irrigation Fund will be created in NABARD with an initial corpus of about Rs. 20,000

crore.

– 5 lakh farm ponds and dug wells in rain fed areas and 10 lakh compost pits for production of organic

manure will be taken up under MGNREGA.

– Soil Health Card scheme will cover all 14 crore farm holdings by March 2017.

– Allocation under Pradhan Mantri Gram Sadak Yojana increased to Rs. 19,000 crore. Will connect remaining

65,000 eligible habitations by 2019.

– Allocation for rural sector Rs. 87,765 crore.

– Rs. 2.87 lakh crore will be given as Grant in Aid to Gram Panchayats and Municipalities as per the

recommendations of the 14th Finance Commission.

– 100% village electrification by 1st May, 2018.

– Allocation for social sector including education and health care Rs. 1,51,581 crore.

– “Stand Up India Scheme” to facilitate at least two projects per bank branch. This will benefit at least 2.5

lakh entrepreneurs.

– 62 new Navodaya Vidyalayas will be opened.

– Digital Depository for School Leaving Certificates, College Degrees, Academic Awards and Mark sheets to be

set-up.

– 1500 Multi Skill Training Institutes to be set-up. National Board for Skill Development Certification to be

setup in partnership with the industry and academia.

– Deduction under Section 80JJAA of the Income Tax Act will be available to all assesses who are subject to

statutory audit under the Act.

– 100 Model Career Centres to operational by the end of 2016-17 under National Career Service.

– Total investment in the road sector, including PMGSY allocation, would be Rs. 97,000 crore during 2016-17.

Allocation of Rs. 55,000 crore in the Budget for Roads. Additional Rs. 15,000 crore to be raised by NHAI

through bonds. Total outlay for infrastructure Rs. 2,21,246 crore.

– 100% FDI to be allowed through FIPB route in marketing of food products produced and manufactured in

India.

– Allocation of Rs. 25,000 crore towards re capitalization of Public Sector Banks.

– Bill for Targeted Delivery of Financial and Other Subsidies, Benefits and Services by using the Aadhar

framework to be introduced.

– Fiscal deficit in RE 2015-16 and BE 2016-17 retained at 3.9% and 3.5%.

– Revenue Deficit target from 2.8% to 2.5% in RE 2015-16.

– Withdrawal up to 40% of the corpus at the time of retirement to be tax exempt in the case of National

Pension Scheme (NPS). Annuity fund which goes to legal heir will not be taxable.

– 100% deduction for profits to an undertaking in housing project for flats up to 30 sq. metres in four metro

cities and 60 sq. metres in other cities approved during June 2016 to March 2019 and completed in three

years. MAT to apply.

– Committed to providing a stable and predictable taxation regime and reduce black money.

– High Level Committee chaired by Revenue Secretary to oversee fresh cases where assessing officer applies

the retrospective amendment.

– 13 cesses, levied by various Ministries in which revenue collection is less than Rs. 50 crore in a year to be

abolished.

– Expansion in the scope of e-assessments to all assessees in 7 mega cities in the coming years.

– ‘e-Sahyog’ to be expanded to reduce compliance cost, especially for small taxpayers.

– Surcharge to be raised from 12% to 15% for persons other than company, firms and co-operative societies

having income above Rs. 1 Crore.

– No change in tax rates for individuals, co-operative societies, firms, local authorities and companies.

– 10% rate of tax on income from patent developed and registered in India by a resident.

– Extend the presumptive taxation limit for business to 2 crore and coverage of professionals under

presumptive taxation u/s 44AD.

- – Under NPS, withdrawal upto 40% of corpus is tax exempt.

- – Under superannuation funds, RPF including EPF, upto 40% of corpus to be tax free.

- – Deduction of rent paid u/s 80GG increased to Rs. 60,000/- per annum.

- – Raising the ceiling of tax rebate u/s 87A to Rs. 5,000/-.

- – Introduction of Direct tax dispute resolution scheme 2016.

- – Introduction of Income Declaration Scheme 2016.

– Krishi Kalyan cess @ 0.50% on all taxable service w.e.f. 01.06.2016.

CLICK HERE / CLICK HERE to Download Analysis of Union Finance Bill 2016

Credits & Analysis By: Mohit Gupta, B. Com (H), FCA, LLB